Share this Post

At metasfresh, we pride ourselves on our expertise in solving problems, our focus on creating continuous customer value, and our ability to roll out all the latest improvements and developments to all customers in weekly releases. We are constantly striving to deliver a next-generation open source ERP experience for our users with an emphasis on making our solution powerful, enjoyable, and easy to use.

In our 5.170 Release in July 2021, we have introduced a new feature that is not just powerful, enjoyable, and easy to use — but also extremely timely.

In July, the EU extended and replaced the Mini One Stop Shop (MOSS), in place since 2015, to the One Stop Shop (OSS) model, signifying a single EU VAT return and the withdrawal of distance selling thresholds. Even as this new regulation came into force, we were able to fully integrate and automate support for this new EU special regulation into metasfresh ERP.

But, before we get into a bit more detail on that, a brief history of EU VAT regulations may be in order.

From MOSS to OSS

MOSS came into effect on 1 January 2015 and enabled businesses supplying telecommunication services, television, and radio broadcasting services and electronic services to customers in Member States to account for VAT in one EU country instead of in each country. Businesses simply had to apply the rules of the MOSS scheme to all their EU customers and register with authorities in one EU country to file VAT returns and make payments.

Despite the inherent simplicity of the scheme, there were a few snags. For instance, the exemption for low-value imports created a loophole for abusive practises that impacted tax revenues. The rules also skewed the playing field in favour of suppliers outside of the EU who were exempt from VAT if the goods they supplied were below a certain import threshold.

The new EU OSS regulations are intended to close loopholes, create a level playing field for EU and non-EU businesses, and modernise and simplify VAT rules for the online delivery of goods and services within and to the EU.

Key Features of OSS

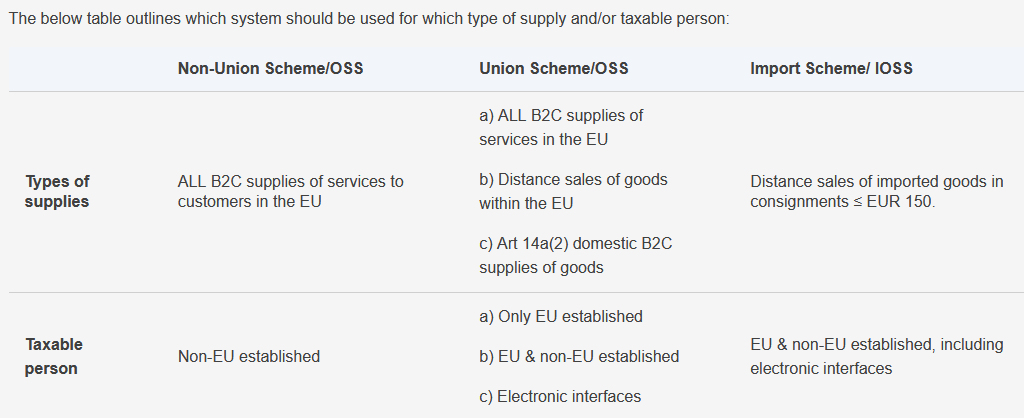

The One Stop Shop framework provides three different schemes — Non-Union, Union, and Import — targeted at different scenarios.

The Non-Union scheme focuses on businesses from outside the EU selling to customers in the EU. The Union scheme is for EU-based businesses that supply goods and services as well as non-EU-based businesses but only for the supply of goods. And finally, there is the Import scheme for EU-based businesses who import goods into the EU. Non-EU businesses who want to avail of the Import scheme will be required to appoint an EU-established intermediary to fulfil their VAT obligations.

The OSS schemes cover all businesses established in the EU and outside. These schemes are optional, and suppliers can instead opt to register in each Member State to which they deliver goods or services to their customers. However, opting for an OSS scheme requires businesses to apply the framework to all goods and services supplied to consumers in all Member States. None of the schemes can be applied selectively to sales in certain markets.

The new One Stop Shop regulation strategically extends MOSS and ends the low-value import VAT exemption regime and replaces it instead with the new Import scheme. In addition, it scraps multiple distance selling thresholds for a unified threshold for the sales of goods across the EU. It also introduces new deemed supplier rules that designate online marketplaces, like Amazon, for example, for collecting and reporting VAT. Under OSS, deemed suppliers can report VAT for supplies within and between EU countries, even if the seller is not established in the EU.

Benefits of OSS

The One Stop Shop concept significantly simplifies VAT obligations for the supply of goods and services to consumers across all EU Member States. Some of the key benefits of this model include:

- Businesses can now register for VAT electronically in a single Member State for all sales of all eligible goods and services to all EU customers. Previously, businesses selling to countries in which they do not stock goods had to register for VAT in each of those markets. Under the new scheme, these will only have to submit one OSS VAT return.

- Different distance sales thresholds have been abolished and replaced with one EU-wide threshold of €10,000. All cross-border sales up to this threshold will be subject to the VAT rules of the Member State of dispatch, while those above will become subject to the VAT rules of the Member State of destination.

- The elimination of the import VAT exemption threshold and the introduction of the requirement to charge VAT at the rate of their customer’s Member State EU country creates a more efficient Green Channel for quick customs clearance. Businesses just have to register for the newly-introduced Import One Stop Shop (IOSS) scheme and list their unique IOSS identification number on all packages in order to indicate that VAT is being properly declared and filed.

- Businesses can electronically register for VAT in a single Member State, declare VAT and make a single payment and engage with a single tax administration for all their VAT-related needs.

Advantages of the OSS. —Source: ec.europa.eu

The EU OSS VAT returns regulation is expected to expand the annual VAT revenues of EU Member States by EUR 7 billion. It will also help reduce VAT compliance costs for businesses and accelerate cross-border sales.

Of course, the biggest challenge for businesses opting into this new regulatory paradigm will be to incorporate these complex rules into their core enterprise systems.

One-click OSS Integration & Automation with metasfresh ERP

metasfresh ERP customers can automatically set the tax rates for all orders and invoices according to the OSS regulation with just a single click. The metasfresh ERP system already includes all EU tax rates and comes with a powerful configuration engine that supports a range of options such as fiscal representation, small business regulation, and all relevant domestic/EU foreign/non-EU foreign criteria.

Talk to us here at metasfresh if you are looking for a ready-to-use digital solution with integrated OSS functionality to supercharge your digital retail business in the EU.

metasfresh is a member of the Ecommerce and Cross-Channel Club Cologne (ECC Club Köln), which is managed by the Institute for Retail Research Cologne (Institut für Handelsforschung, IFH Köln). The Institute offers individual research projects with strategic consulting. It specialises in the areas of inter-company comparisons as a controlling instrument, enabling retail companies to recognise market developments, measure changes in customer behaviour, optimise sales and set the course for a successful future. The insights and knowledge provided by the Institute through market research and studies relating to cross-channel and online retail are incorporated in the development of metasfresh, meaning all of our users are always up to date on the latest ecommerce developments.

At metasfresh, our mission is to enable each and every company to access a powerful ERP system that supports digital transformation and fuels corporate growth. Get in touch today for more information and insights.

Share this Post