Share this Post

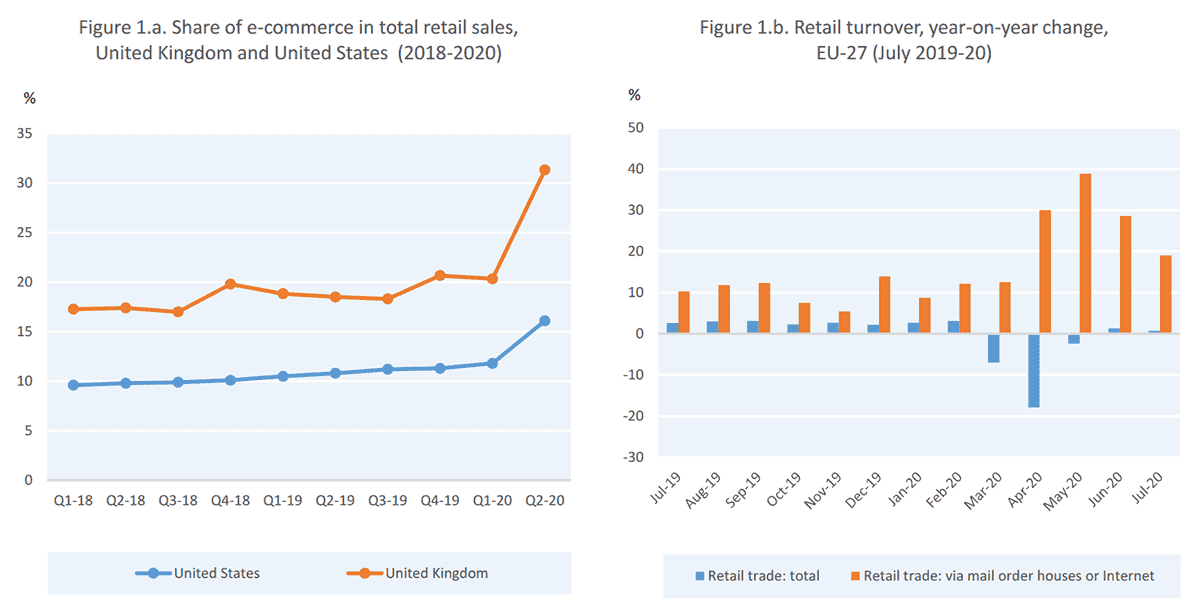

A 2021 UNCTAD report estimates that the restrictions wrought by the ongoing pandemic have helped ecommerce boost its share of total retail sales, from 16% to 19% in 2020. According to the latest available figures, global e-commerce sales hit nearly $27 trillion in 2019, up 4% from 2018.

The COVID-19 crisis has increased the share of e-commerce in total retail. —Source: oecd.org

At the same time, the primacy of ecommerce in providing convenient and safe access to a range of products has also helped expand the scope of ecommerce to new firms, new consumer segments, like the elderly, for example, and new categories, like food and groceries.

In the US, for instance, the grocery sector — where ecommerce penetration rates previously lagged that of more mainstream categories like beauty, apparel, and electronics — witnessed online penetration increase threefold to hit an all-time high of 12% in 2020. In fact, this disruptive shift that added years’ worth of growth in just a matter of months is expected to increase e-grocery penetration to as much as 18% over the next five years.

This trajectory, however, is not unique to the US, with the COVID-19 crisis fast-forwarding Europe’s ecommerce grocery sales by four to five years.

The pandemic has catalysed new purchasing behaviours that significantly expand ecommerce opportunities for retailers. At the same time, it has also triggered a novel competitive dynamic where the emphasis has shifted from price to convenience, customer service and shopping experience. Not only is this likely to be a long-term shift, but this also has the potential to ripple out, in some form or the other, to categories beyond food and grocery.

And this, in essence, is the case for quick commerce or q-commerce.

The Rise of Q-Commerce

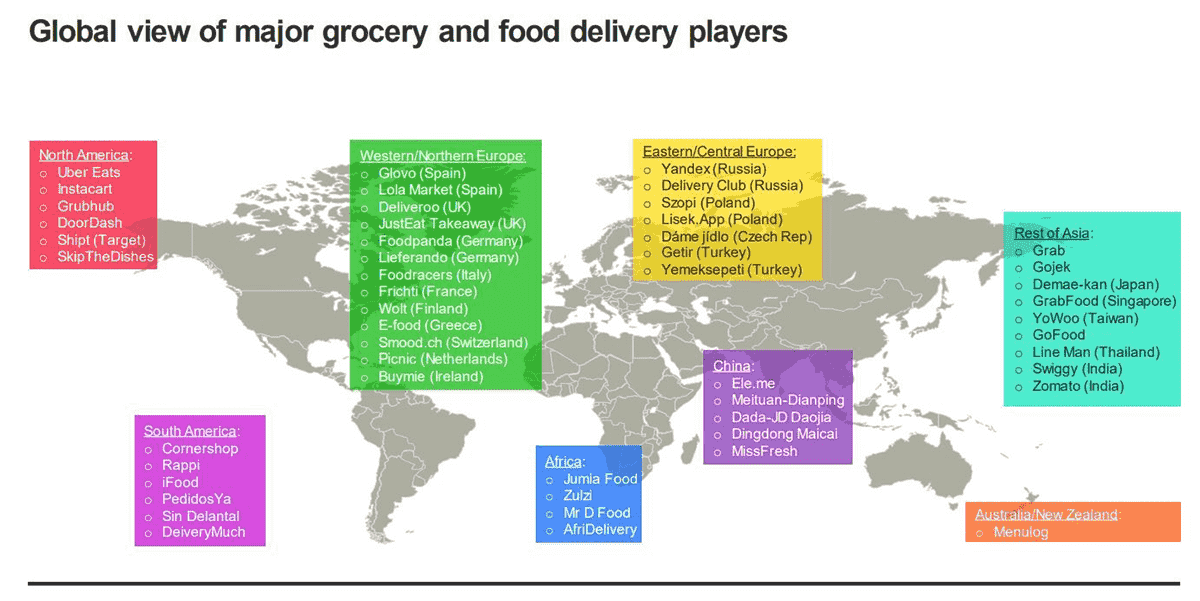

As the last-mile grocery delivery model in the US evolves into a combination of instant, same-day, and click-and-collect, more and more grocers are partnering with third-party providers, like Instacart, for example, to redefine their ecommerce value proposition around contactless shopping experiences and expedited delivery. At the same time, food delivery platforms, like DoorDash, are also branching out into the grocery delivery market alongside established names like Amazon Fresh.

With instant deliveries and user experience becoming critical value differentiators in the global last-mile food and grocery delivery market, a new breed of tech-savvy startups, exploring a range of innovative technologies like artificial intelligence, dynamic route optimisation, and autonomous delivery robots, are positioning themselves to disrupt the ecommerce supply chain. And with COVID-19 minimising activity in offline grocery channels, the competition in the quick commerce space is quickly heating up. As a result, global revenues in the last-mile food and grocery delivery market are expected to triple, from around $25 billion in 2020 to just over $72 billion in 2025.

Competitor Landscape. —Source: linkedin.com

The promise of q-commerce, the next generation of ecommerce, is centred on speed. Also referred to as ‘on-demand delivery’ or ‘e-grocery’, it is an evolutionary strand of ecommerce that delivers small orders — rather than weekly groceries — within minutes, typically under an hour, rather than days.

This type of extreme time-sensitive fulfilment typically relies on a network of dark stores — i.e., strategically located warehouses and fulfilment centres that facilitate quick delivery of goods to customers. And it’s not just startups — many retailers are converting retail storefronts into mini-fulfilment centres.

As critical as the dark store model is to the success of q-commerce, it is not without a few inherent challenges. For instance, balancing profitability and product availability with a cost-effective

customer experience will require a high degree of precision and sophistication in inventory management. It will also require a hyper-localised, granular, and dynamic approach to demand forecasting that boosts fulfilment performance while minimising unproductive stock. And then there is the tricky issue of perishables with an extremely limited window to value and beyond which is either waste or an unwholesome customer experience.

Startups in the q-commerce space are betting big on dark stores. Earlier in 2021, on-demand delivery platform Glovo announced a €100 million partnership with Swiss-based real estate firm Stoneweg to expand its dark store network across Europe from 18 to 100 by the end of the year. Meanwhile, Deliveroo, which already partners with several major European retailers, recently launched a rapid grocery service called Hop that will operate from delivery-only grocery stores.

All of which leads to the big question — is q-commerce a transitory trend or the future of post-pandemic retail?

Hype or Megatrend?

Historic data provides very little validation of the sustainability of on-demand rapid delivery ecommerce. One of the earliest experiments in what is known today as q-commerce was launched in 1998 with a company called Kozmo.com that shut down in 2001 due to the challenges of making the business model work at scale. Then came Philadelphia-headquartered Gopuff in 2013, which has raised 75% of its $3.4 billion funding in the past 12 months.

Then there are concerns of the long-term profitability of a model focused on last-mile deliveries, the most expensive part of the fulfilment chain, and on a market segment characterised by small order values and low-profit margins.

However, JP Morgan analysts note that q-commerce has the potential to become the 3rd significant disruption in the grocery market and operate at a higher degree of profitability than convenience stores with a long-term focus on basket size, delivery fees, and driver utilisation rates. Plus, key q-commerce players like Glovo are already looking beyond groceries to a wider range of products that includes toys, music, books, flowers, and beauty products. Just earlier this month, Xiaomi announced a partnership with foodpanda, a food and grocery delivery platform owned by Germany’s Delivery Hero, to drive ‘quick commerce’ of electronics in Singapore and Thailand.

Most indications are that the on-demand rapid delivery model first tested unsuccessfully in the dot-com nineties and now christened q-commerce may well be the future of post-pandemic retail. For one, most major retailers seem to be invested in the concept through their own last-mile programs or through startup partnerships. Also, technological developments over the past two decades — in advanced analytics, dynamic route optimisation, smart tracking, etc. — have significantly augmented the technical and commercial feasibility of executing last-mile deliveries. And finally, even post-pandemic, what would a modern digital consumer rather do when faced with an ingredient shortage in the middle of preparing a meal? Walk to the grocer’s or simply pull up a smartphone app that promises a sub-10-minute delivery?

Talk to us here at metasfresh about how you can get started with q-commerce utilising the power of metasfresh Cloud.

metasfresh is a member of the Ecommerce and Cross-Channel Club Cologne (ECC Club Köln), which is managed by the Institute for Retail Research Cologne (Institut für Handelsforschung, IFH Köln). The Institute offers individual research projects with strategic consulting. It specialises in the areas of inter-company comparisons as a controlling instrument, enabling retail companies to recognise market developments, measure changes in customer behaviour, optimise sales and set the course for a successful future. The insights and knowledge provided by the Institute through market research and studies relating to cross-channel and online retail are incorporated in the development of metasfresh, meaning all of our users are always up to date on the latest ecommerce developments.

At metasfresh, our mission is to enable each and every company to access a powerful ERP system that supports digital transformation and fuels corporate growth. Get in touch today for more information and insights.

Share this Post