Share this Post

Organisations around the globe have spent the last twelve months scrambling to adapt to the most extraordinary of circumstances. The COVID-19 pandemic has reshaped the entire world — from where we work, to how we buy, how we meet, and from where we source our personal and business goods.

With vaccines being rolled out, there is now light at the end of the tunnel, and so businesses can start strategizing — looking forward to how they might shape their futures, rather than continuously fighting fires in the present.

To do so, it is crucial to assess and address key trends that will drive business in the post-COVID-19 world — and a recent report from PwC has identified seven of them. Some of these trends are industry specific, or concern particular products, markets or regions only. Others, however, are broader — affecting nearly all businesses, no matter how, where, or in which region or industry they operate. Of these, some are trends that COVID-19 has brought into being — while others were pre-existing, but have been significantly accelerated or altered as a result of the pandemic.

Let’s take a look at them.

Trend 1 — De-Globalisation

What PwC says: “COVID-19 has shown the downsides of globalisation, leading companies to rethink how they manage their supply chains, especially around purchasing and sourcing. This will probably result in shifts in production locations and customer focus.”

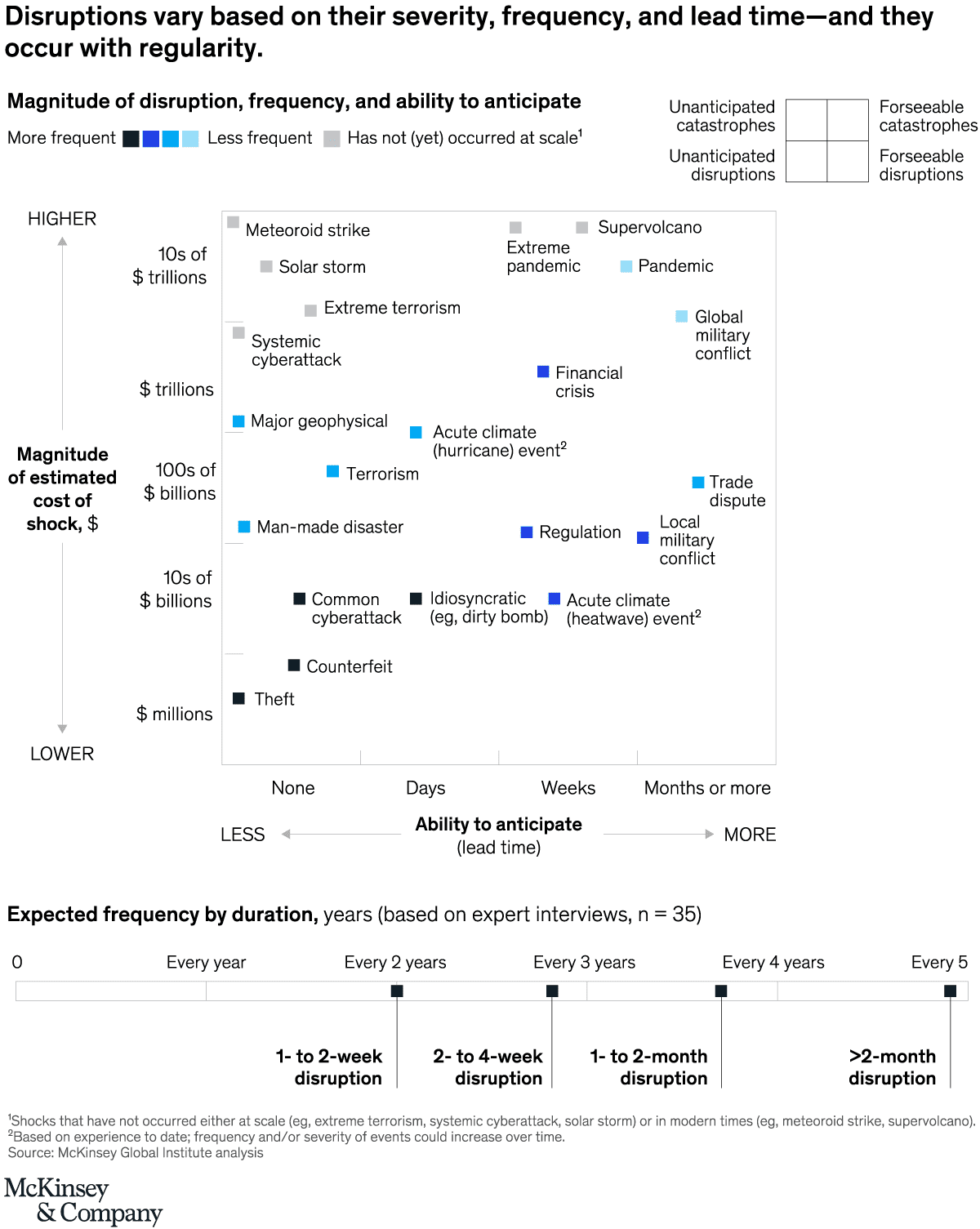

As well as being a global health crisis, COVID-19 has been a supply chain crisis. The pandemic, indeed, revealed some serious vulnerabilities in the long and complicated supply chains of many companies. And while supply chain disruptions are nothing new, as a report from McKinsey revealed last year, they are increasing in frequency and severity. In fact, the report finds that disruptions that last a month or longer now occur once every 3.7 years on average — and take a severe financial toll on the companies involved.

Different types of shocks based on their magnitude and predictability. —Source: mckinsey.com

Nonetheless, many companies did not fully appreciate or assess their risks and global dependencies until this year. Now they know better and must strategize accordingly — perhaps by increasing inventory, or formulating back-up plans with existing or alternative suppliers. Whatever the strategy, they need real-time data and insights to build the necessary resiliency into the supply chain. And this is precisely why more and more companies are turning to next generation cloud-based ERP solutions like metasfresh to keep constant track of their resources.

Trend 2 — Remote Interaction

What PwC says: “Customers and companies have had to learn how to work together remotely during the crisis. Due to this behaviour, communications preferences may have changed for the long-term, impacting how individual departments and business functions will operate in the future.”

From virtual meetings via Zoom to an explosion of cloud-based communication, collaboration and productivity tools — being forced into remote work has fundamentally changed how we interact with one another in the workplace, and how both consumers and business buyers interact with the organisations they purchase from.

Undoubtedly, our relationship with the office has changed forever — meaning companies must now transform their operations to accommodate remote interactions with customers (such as with guided selling or spatial web technologies), with employees, and with suppliers and partner organisations using cloud-based business management and remote collaboration tools.

Trend 3 — Flexibility

What PwC says: “Moving forward, companies will put a much greater value on flexibility to safeguard their margins in future challenging situations. This will impact areas such as process and function outsourcing, external staffing models and remote working.”

Visibility is key here — again, highlighting the importance of deploying modern and powerful technology solutions like a cloud-based ERP to manage wide-spread business functions from within a single, centralised, fully-integrated system. The beauty of an ERP system like metasfresh is that it provides the complete helicopter view of the entire organisation. How? By combining all data from all departments into a single database, application, and user interface that all team members can use to keep track of everything that’s going on in the company and connect all departments together. This includes everything from supply chain management to finance and accounting, business intelligence, sales, marketing, and human resources.

Of course, moving key enterprise applications like ERP systems to the cloud can be challenging. That’s why at metasfresh, we have developed our metasfresh Cloud Vision to make this move as seamless and straightforward as possible. We believe that ERP software should be adapted to the user and not the other way around. In a post-pandemic world where a remote or hybrid workforce looks set to be a permanent feature, it’s crucial you can take advantage of a flexible cloud-based ERP solution that keeps all employees connected with each other — as well as with your external business partners. That’s why we’ve built metasfresh Cloud to not only be powerful, but simple to use — even for people that have never worked with ERP software before.

Read more: Accelerating Digital Transformation: The metasfresh Cloud Vision

Trend 4 — Digitalisation and Automation

What PwC says: “As a result of the crisis, companies will try to reduce costs through greater efficiency, while gaining greater control, for example through investments in process automation, ecommerce, innovative software and IT.”

The report goes on to highlight how digital sales, especially ecommerce and mobile commerce, have proved crisis resistant — and have even increased in many cases. In addition, the report concludes that companies with an integrated multi-channel sales approach were able to react more flexibly to the challenges created by the pandemic, shifting sales volumes dynamically to digital sales channels.

A recent report from Ecommerce Europe finds, unsurprisingly, that the closure of brick-and-mortar shops positively impacted online sales, with two-thirds (66.74%) reporting a large increase in sales across digital channels as a result of the pandemic.

In terms of the perception of ecommerce during the COVID-19 crisis, all respondents from all countries reported a positive public perception, including a positive political perception for most of the contributions. Shopping habits may indeed have changed forever throughout the pandemic — and although many people will indeed return to physical retail, moving forward, organisations must place greater emphasis on digital sales channels to meet evolving demands.

The impact of COVID-19 on the perception of e-commerce per country. —Source: ecommerce-europe.eu

PwC recommends the development of a 360-dgree sales strategy. “This should adjust operating models to cover digital sales, as well as customer service integration, customer engagement and optimize sales touchpoints and Point of Sale (PoS), enabling more dynamic pricing. A scenario-oriented digital sales strategy will generate instant and potentially high ROI if companies need to revert to crisis mode in the future.”

Read more: Why Headless Commerce Is the Future of Digital Sales – And Why ERP Integration Is Crucial

Trend 5 — Market Consolidation

What PwC says: “Weak players will be acquired by stronger competitors or go bankrupt and disappear.”

There have been winners and losers throughout the pandemic. For those organisations that had already embraced digital transformation, the crisis hasn’t stopped them. Through the power of cloud-hosted business management, collaboration and communication technologies, business continuity has been ensured. On the other hand, many of those that had been previously slow to digitalise have not survived. This trend will likely continue in the post-pandemic world. As Mary Meeker, author of the annual Internet Trends Report recently put it, the COVID-19 crisis is separating companies with strong digital adaptability from those without it.

Read more: Surviving Digital Darwinism through Customer Centric Cultural and Digital Transformation

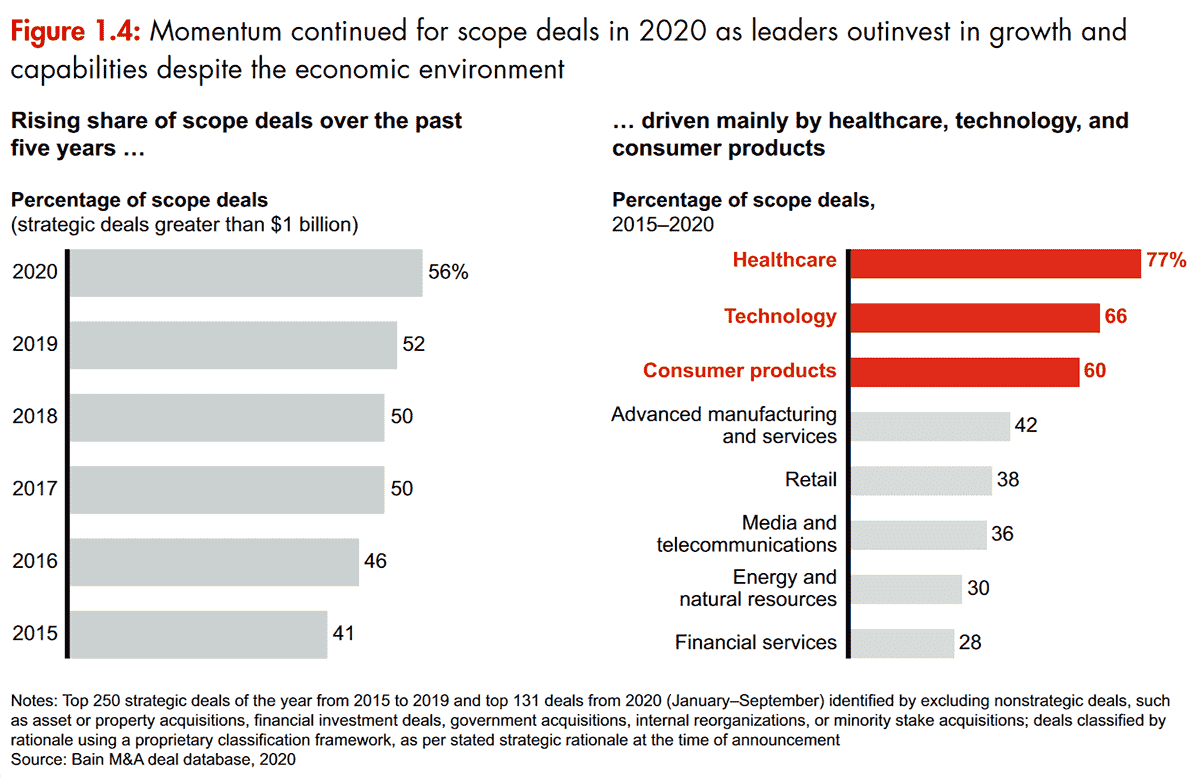

Meanwhile, as larger companies are strategizing for the future and assessing opportunities for resilience and growth, many are looking to mergers and acquisitions (M&A) as we come out of the economic downturn. Understandably, M&A activity dropped dramatically in the early months of COVID-19 — however, it rebounded in the second half of the year, rising more than 30% in third and fourth quarters, according to Bain & Company’s Global M&A Report 2021.

As the market continues to digitalise and consumers become more and more comfortable with ecommerce, Bain identifies an increase in the share of scope deals aimed at helping companies expand into fast-growing markets, or to gain new, mostly tech and digital, capabilities. This trend continued in 2020, with scope deals further increasing volume share to 56% of all deals worth more than $1 billion, compared with 41% in 2015. The need for new critical capabilities was at the heart of many recent scope deals, says Bain. For example, consumers’ growing demand for direct delivery drove Target’s acquisition of Deliv, Nestlé’s acquisition of Freshly, and Ahold Delhaize’s acquisition of FreshDirect.

Continuous appetite for growth and new capability assets. —Source: bain.com

Additionally, as companies look to shore up increasingly local supply chains, there has been a decline in cross-regional M&A in favour of local or regional deals. About 60% of Bain’s survey respondents said supply chain localisation will be a significant factor in evaluating deals going forward.

Trend 6 — Price Volatility

What PwC says: “As supply and demand change more rapidly than usual, many companies’ cost and profitability structures, as well as customers’ willingness-to-pay will vary, resulting in more frequent price increases and decreases.”

The report rightly points out that both B2B and B2C customers may be facing financial challenges as a result of the pandemic. While they require your support, they also pose a threat to your bottom-line — if B2B customers have no cash flow, for instance, they won’t be able to pay bills and may cancel planned orders. In this case, PwC suggests switching to upfront payments or extending payment terms may be viable solutions — though cautions that any discounts offered be only for a limited time or bound to single orders, in order not to damage long-term profitability.

Other business rules should also be reviewed and potentially adjusted, such as minimum order quantities, order changes, frozen zones and delivery options, says PwC.

The report also notes that a lot of businesses currently wish they had transparent data across their supply chains. This would allow them to react quickly to unforeseen challenges and changes — across both supply and demand — allowing them to rapidly execute price changes to ensure business targets are met. Again, implementing next-generation ERP solutions like metasfresh can unlock a treasure trove of supply chain data and prescriptive analytics capabilities, giving organisations the insights they need to make data-driven decisions about pricing strategies.

Read more: How a Modern ERP Can Unlock a Data Goldmine for Prescriptive Analytics

Trend 7 — Focus on Core Competencies

What PwC says: “Competition in some industries could increase with companies suffering from financial losses shrinking certain operations and concentrating on high margin businesses in order to make them their core competence.”

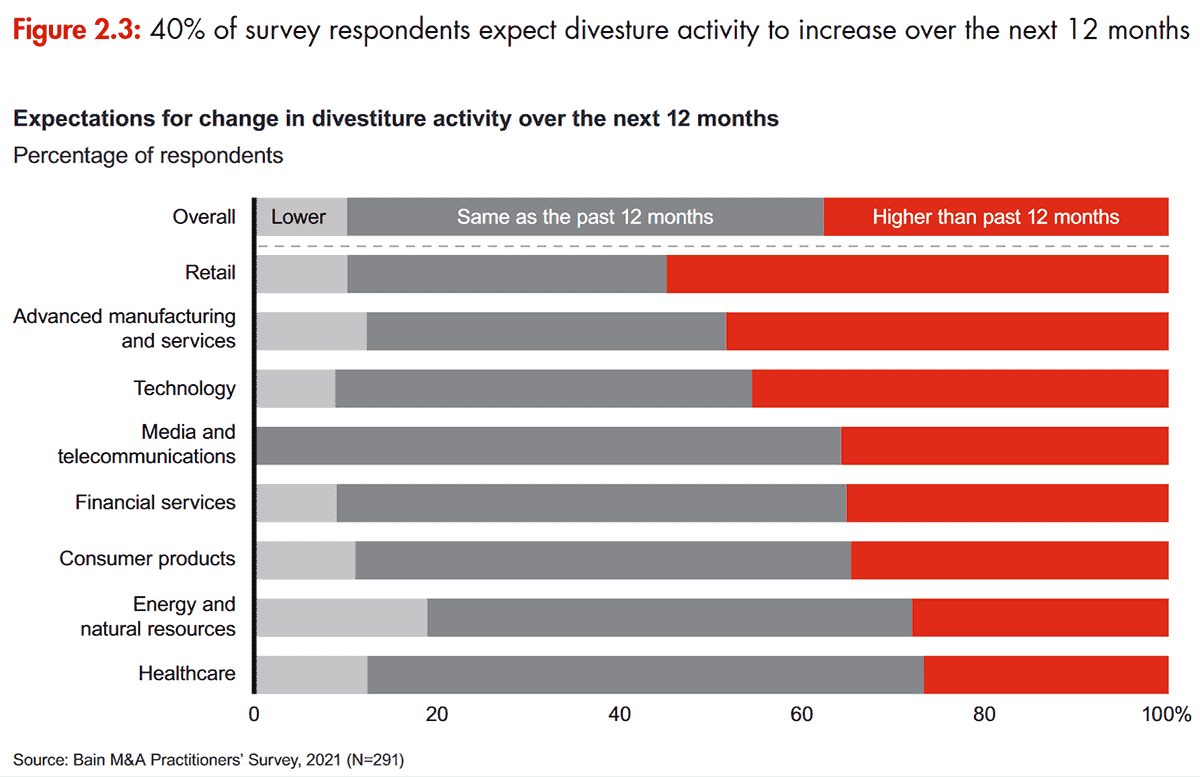

Bain’s report concurs, with respondents reporting a greater urgency to divest non-core assets and divert their scarce resources to the best opportunities amid increasing industry disruption. Though divestiture volume was down 15% in 2020, and value dropped by 21%, Bain anticipates a sharp increase in corporate divestiture activity in 2021 and beyond.

Roughly 40% of the nearly 300 M&A practitioners surveyed expect a rise in divestitures over the next 12 months — while only 10% felt that it would be lower. The industries that were hardest hit during the pandemic, including retail, will likely see the highest level of divestiture activity, Bain concludes.

Divesting during Covid-19. —Source: bain.com

metasfresh Open Source ERP

Talk to us here at metasfresh to learn more about how metasfresh Cloud ERP can power your post-COVID-19 strategy.

metasfresh is a member of the Ecommerce and Cross-Channel Club Cologne (ECC Club Köln), which is managed by the Institute for Retail Research Cologne (Institut für Handelsforschung, IFH Köln). The Institute offers individual research projects with strategic consulting. It specialises in the areas of inter-company comparisons as a controlling instrument, enabling retail companies to recognise market developments, measure changes in customer behaviour, optimise sales and set the course for a successful future. The insights and knowledge provided by the Institute through market research and studies relating to cross-channel and online retail are incorporated in the development of metasfresh, meaning all of our users are always up to date on the latest ecommerce developments.

Since 2006, we’ve been developing our ERP software non-stop with open source components and under the open source licences GPLv2 and GPLv3. Our mission is to enable each and every company to access a powerful ERP system that supports digital transformation and fuels corporate growth. Get in touch today for more information and insights.

Share this Post